Posted On: March 1, 2024 by San Luis Valley Federal Bank in: Financial Education

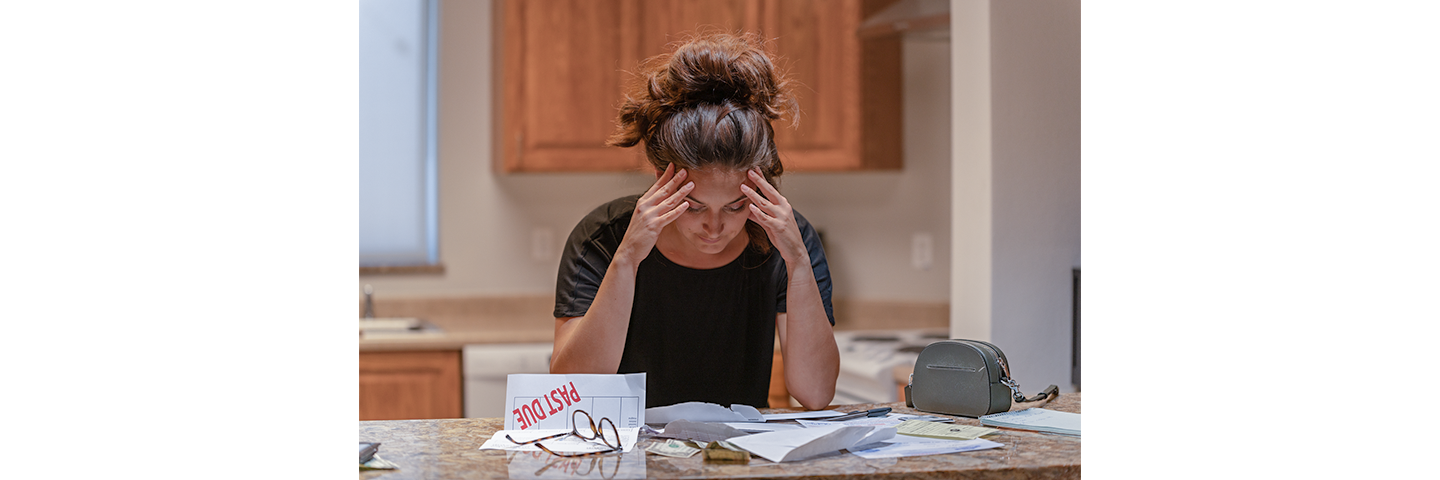

Confronting an Unspoken Reality: Financial Trauma Affecting Money Management.

In the realm of financial education, there exists a subject rarely discussed: financial trauma. Yet, despite its taboo nature, its impact reverberates through countless lives, often quietly shaping financial behaviors and attitudes.

However, recognizing and addressing financial trauma isn't always met with open arms. Some may view it as an unnecessary intrusion into personal matters or dismiss it entirely, believing financial struggles result from poor decision-making. However, the reality remains that traumatic financial experiences can profoundly influence individuals' financial behaviors, often leading to patterns of avoidance, overspending, or even self-destructive financial habits.

A survey completed by Experian, a consumer credit reporting company, discovered that two-thirds of adults have experienced financial trauma. Nearly 70% of adults feel they have suffered or are currently suffering from financial trauma, experiencing negative thoughts, flashbacks, and anxiety when dealing with financial issues.

Trauma isn't like our usual stress; it doesn't come and go in waves. Financial trauma can cause negative thoughts, anxiety, avoiding paying bills, compulsive spending, or even resource hoarding.

Financial trauma may be triggered by:

-

Financial insecurity

-

Divorce

-

Economic Crisis / Uncertainty

-

Overwhelming Debt (Medical, Education, Generational, Credit Cards)

-

Abusive relationships that use money for control or harm

Although this list isn't comprehensive, it illustrates the widespread prevalence of financial struggles. For anyone experiencing challenges in managing their finances, it could be beneficial to dig deeper and examine underlying triggers that need to be addressed.

While San Luis Valley Federal Bank is dedicated to providing financial education and management resources, we understand that addressing financial trauma may require specialized support. We offer free resources to help you develop healthy financial habits and empower you on your financial journey. These include topics such as Building Better Credit, Debt Management, and Taxes: The Basics.

Understanding and managing financial trauma can be overwhelming, but you don't have to face it alone. We have knowledgeable staff, such as Ramona, Mindy, and Pauline, who are available to offer support and guidance tailored to your unique situation. Feel free to reach out to us for confidential assistance with your financial challenges or banking inquiries. We're committed to helping you navigate your financial journey with confidence.

Remember, seeking help that best fits your needs is important and worthwhile. If you've been impacted by financial trauma, consider reaching out to a professional for support, such as therapists, counselors, support groups, or financial advisors specialized in financial trauma.

If you would like to dive deeper into Financial Trauma, the symptoms, causes, and how to cope with Financial trauma, visit: https://www.choosingtherapy.com/financial-trauma/

They also have an excellent 5-minute introductory video.

0 comments