Posted On: June 15, 2023 by San Luis Valley Federal Bank in: Financial Education

SAN LUIS VALLEY FEDERAL BANK JOINS ABA FOUNDATION’S

SAFE BANKING FOR SENIORS CAMPAIGN

We are joining the American Bankers Association Foundation’s Safe Banking for Seniors campaign. We will mobilize bankers across the Valley to educate older Americans, their caregivers, and other family members about identifying and preventing elder financial exploitation.

“We’ve found that bankers are often the first line of defense against elder financial fraud and abuse. As many older customers visit bank branches, bankers are educating and advising their members on ways to protect their assets and identity,” said San Luis Valley Federal Bank Amanda Gallagher, BSA Officer. “We take our role seriously, and the more we can educate others, the better we can protect our members and our communities.”

In this blog post, we will briefly provide information on identifying and avoiding scams:

What is a Scam?

-

A scam is a trick a con artist plays on an unsuspecting victim

-

The goal is to extort money

-

If the scam succeeds, the victim’s money is gone, and so is the scammer

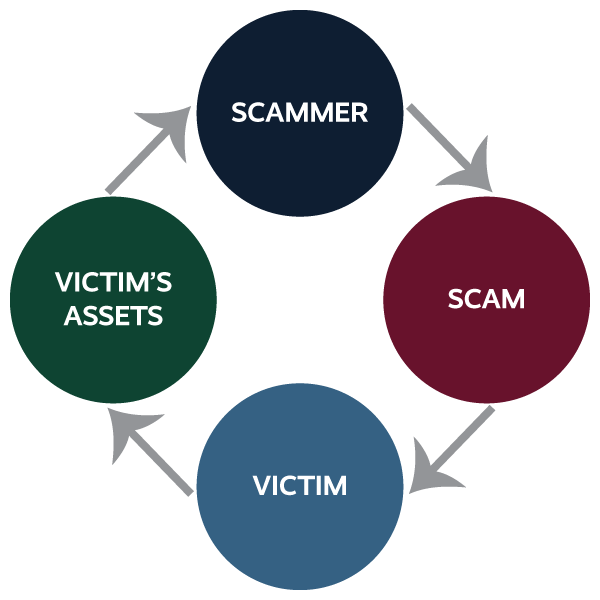

The Pattern of Fraud

Profile of a Scammer

A master of persuasion with a plausible story or the ultimate salesperson with a tempting offer.

-

Easily pinpoints a victim’s vulnerabilities

-

Quickly gains trust

-

Shows no mercy - which means the scammer doesn’t back off even if it’s clear that the victim has limited resources, is disturbed, or otherwise upset

How Scammers Find You

-

Buy contact information - buying contact information is easy. Scammers can purchase survey responses and buy email contact lists, magazine subscription lists, and organization membership lists. Using that information, they set up robocalls and send mass mailings or email blasts to attract response.

-

Prowl online and on social media sites - the advantage of prowling online and on social media sites is that too many people reveal too much about themselves, giving the scammer a valuable touch point. The scammer identifies and reaches out to individuals who have provided a useful opening.

-

Infiltrate groups to which you belong to - the reason to infiltrate groups—such as veterans’ organizations, professional or political associations, houses of worship, or anywhere people with similar interests gather—is that people are more likely to be receptive to scams hatched by someone who seems to share their interests or values, or claims to have a friend in common.

-

Go door-to-door - scam artists who are skilled at selling paving jobs, asking for donations, or peddling expensive products and willing to go door-to-door aren’t using high-tech methods like online scammers. But they can rip off people as effectively as a master of the Internet.

Scammers and Victims

-

Scammers are highly skilled at their trade

-

Appeal to emotions: sympathy, fear, loneliness:

Sympathy for the less fortunate is essential to charity scams, a senior’s fear of running out of money might explain an interest in sweepstakes or lottery scams, a pressing financial need might explain get-rich-quick investment scams, loneliness is essential to a new best friend or sweetheart scams, and even vanity might explain miracle-cure drug scams.

-

Don’t take “no” for an answer!

-

Insist on secrecy:

Scammers don’t want the victim to have time to think about the deal, check out any of the details, or talk to anyone who might advise caution. In some cases, especially in an affinity scam, they’re trying to build a tight bond between themselves and the victim to increase the chance of success.

-

-

Victims are vulnerable

Solving the Scam Problem

-

The scam problem has one solution: knowing how to protect yourself.

-

To do that, you must recognize a scam when you see it!

Most Common Types of Scams

Giveaways: winning the prize, lottery, a free trip

-

Scammers often say you’ve won a foreign lottery or that you can buy tickets for one. Messages about a foreign lottery are almost certainly from a scammer. It’s illegal for U.S. citizens to play a foreign lottery, so don’t trust someone who asks you to break the law. Secondly, if you buy a foreign lottery ticket, expect many more offers for fake lotteries or false investment “opportunities.”

-

It requires an immediate response.

-

You have to make an up-front payment, though the reason you’re given will vary, depending on the specific scam. For lottery scams, the scammer will often tell you that you must pay customs or administrative fees, taxes, or provide some payment for a bogus charge. But it’s all a lie. Don’t do it!

"The video shown above is hosted outside of this website. You may view our external website disclaimer here."

Sweetheart Scam

-

One of the most vicious scams is sometimes called the “sweetheart” scam. In 2021, $547 million worth of losses were reported to the Federal Trade Commission due to these scams. In these cases, scammers create fake profiles on dating sites and apps, or they may reach out through social media sites.

-

In a common scenario, after a period of increasingly affectionate emails or sometimes phone calls, the scammer may propose marriage or commitment to a long-term relationship. But you won’t be able to see the scammer in person. They will say that they’re abroad for business, part of the military, or work on an oil rig, among other excuses.

-

At some point, the scammer will either ask you to send money, or they will share about a hardship of some kind to encourage you to send money. The alleged situation doesn’t have to be too complicated. It could be about plane tickets, customs fees, or other traveling documents. Alternatively, they may talk about a fake surgery, medical expenses, or even gambling debts.

-

But the goal is always the same—to take your hard-earned cash. The ending is no surprise. At some point, the emails and calls, along with thousands—and sometimes hundreds of thousands—of dollars, are gone.

Family Imposter Scam

-

Urgent call from a scammer posing as a family member or dear friend

-

A family member or caller in serious trouble

-

Money required immediately to resolve the problem

-

Secrecy is paramount

Government Imposter Scam

-

Scammers will call, email, text, or direct messages to you on social media.

-

They may claim that you did not appear for jury duty and must pay a fine or will be arrested.

-

They will say that you will be fined, arrested, or deported if you do not pay taxes or some other debt right away.

-

Fraudsters may say that your Social Security or Medicare benefits have been suspended.

-

Scammers may say that you owe back taxes or indicate that there is a problem with your return and ask you to verify your personal information, such as your Social Security number.

-

-

As with each of the scams we’re covering, it’s important not to send money to anyone who calls, texts, emails, or direct messages you on social media. Keep your Social Security, bank account, debit, and credit card numbers to yourself. And, never make a payment to someone you do not know. If you want to know if there’s a real issue, call the appropriate agency directly, but do not use any number that a potential scammer provides.

"The video shown above is hosted outside of this website. You may view our external website disclaimer here."

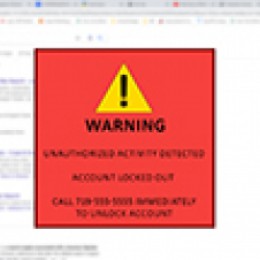

Tech Support Scam

-

Often, they begin through two main ways: a pop-up warning displaying a fake error message with a number to call. Alternatively, scammers call and impersonate a legitimate company, such as Google, Apple, Microsoft, HP, Cannon, or some other company.

-

The goal is to convince the victim to provide scammers with remote access to the victim’s computer. Once scammers obtain remote access, they will perform a fake scan and pretend to troubleshoot the computer to resolve a non-existent problem. They may also install applications on the victim’s computer to access personal information.

-

Once the scammers are finished, they may try to sign the victim up for a bogus subscription service, requiring regular payments, or simply take a one-time payment for their scam. Either way, the entire situation is fraudulent, and at the end of it, the scammers have the victim’s money and access to the victim’s personal information.

Phony Charities Scam

-

Urgent plea for humanitarian help

-

Pressure to make an immediate donation

-

Sometimes quasi-legitimate

-

Sometimes little more than a sad story and a carefully chosen name

-

If you question a charity, search for it at www.charitynavigator.org. Among other things, you’ll find a scorecard for registered organizations showing the percentage of the money raised that actually goes to the mission and the percentage that goes to raising the money. If a name doesn’t appear on these lists, it may not be registered.

Investment Tips or Deals "Too Good to Pass Up" Scam

-

The investment is described as risk-free

-

Any investment—except bank CDs and U.S. Treasury issues—carries the risk that you could lose money. With those exceptions, no investment is ever risk-free.

-

-

Above-average return guaranteed

-

No investment except a bank CD guarantees a return, to say nothing of an above-average return.

-

-

Immediate purchase is often required

-

Immediate purchase of a legitimate investment is virtually never required. It is true that the prices of most investments do change, up and down. But those changes can’t be predicted. And the argument that there are just one or two openings left is nonsense.

-

-

Fees and commissions ignored or obscured

-

Scammers never want to talk about how much money they’ll make by selling you an investment, provided that the investment is legitimate, to begin with. So, they won’t mention the cost and will deflect any questions you ask about expenses.

-

-

Contact the U.S. Securities and Exchange Commission. You can either use their website at www.sec.gov, or directly contact the Office of Investor Education and Advocacy at (800) SEC-0330 to see if an investment is legitimate.

Contractor Scam

-

Many seniors’ biggest investment is their home, which sadly may make them vulnerable to a particular category of scammer—the unscrupulous contractor.

-

Solicits a job by pointing out an “urgent” problem

-

Asks for up-front payment in cash

-

Begins the job but claims it’s much more serious than initially thought

-

Demands more money

-

Disappears with the work unfinished

Spotting Scams

-

All scams have warning signs

-

You have to act right away

-

You can’t tell anyone

-

You must send money in cash or by reloadable debit card, wire transfer, or money order

-

-

Hang up! Hit delete! Slam the door! While this may be considered rude, it’s a very effective method to keep you from being scammed.

Why Seniors are Targeted by Scammers

-

Most seniors have regular income from Social Security; others may receive dividends, interest, or pension income. Many have also accumulated substantial assets, often by spending carefully. Scammers can’t resist the temptation.

-

Some seniors may be more trusting and willing to listen than younger people.

-

If seniors are lonely, they may be grateful for attention.

-

They may also be eager to help when they can, so may be especially vulnerable to pleas for charitable contributions or ways to help someone in need, especially family members.

Block those Scammers

-

Say that the first line of defense against fraud is to limit access. As the first bullet suggests, you can make your phone a barrier rather than a gate. Say that you can reduce unsolicited calls, making it easier for you to recognize when a call is a scam. You can accomplish this in several ways:

-

Register with the National Do Not Call Registry at www.DoNotCall.gov. Caution though that charitable groups are exempt from the prohibition against calling, as are any organizations with which you have done business. Not everyone— especially not scammers—follows the rules, but signing up is a good start at building a defense.

-

If you answer a call that’s from someone you don’t know, hang up. There’s no law that says you have to be polite. Or you could say, “I’m sorry, but I don’t know you. Thanks for calling anyway.” If someone claims to represent a charity, you might say something like, “I’m sorry, but I donate locally, so I won’t be able to donate to your charity.”

-

-

Reduce, though not eliminate, the amount of junk mail you receive.

-

Register with www.DMAchoice.org. That will stop some, though not all, junk mail and cut down on scam mail.

-

Throw out mail you’re not expecting or from sources you don’t recognize. But be sure to shred anything that has to identify information that a thief could use to apply for a credit card or loan or write a line-of-credit check in your name.

-

Everyone with a computer should have anti-virus software. In most cases, there’s an annual charge for this protection. And it’s generally wise to get professional help in selecting and installing the software. While it may seem an unnecessary expense, it’s well worth the cost.

-

You should never open emails from senders you don’t recognize. If you get an email that appears to be from someone you know but seems suspicious, it’s smart to delete it before opening any attachments or links it contains. Sometimes scammers hijack email addresses and send phony emails to everyone in the owner’s address book. If you’re unsure if emails from known contacts are suspicious, call them to see if they did indeed send the email.

-

Be very guarded about the information you provide on social media sites. Scammers looking for victims can—and do—use the personal information you provide to victimize you.

-

Build Your Scam Defenses

-

Be suspicious of any situation that requires you to send money upfront

-

Assume that insistence on secrecy is a ploy to deceive

-

Confirm all stories, offers, or charities independently

-

Choose the privacy settings on social media accounts

If You're a Scam Victim

-

Don’t be embarrassed or afraid

-

Tell someone you trust

-

Report the scam to your bank

-

Contact the police and federal agencies

Your Bank Can Help

-

Monitor your account for unusual activity

-

Ask why you are withdrawing large amounts of cash

-

Suggest giving a person you trust access to review your account activity

-

Explain why scammers prefer certain payment methods

-

Provide referrals to a licensed broker or registered investment adviser

PDF - Identifying Scams and Preventing Identity Theft Resource Sheet

0 comments